INTELLECTUAL PROPERTY PROTECTION SERIES FOR YOUR SMALL FOOD BUSINESS

Five Types of IP and Which Ones Might You Might Need to Protect in Your Foodie Business

Protecting intellectual property (IP) is a something cottage foodies worry too much about… or maybe not enough.

What is worth protecting? And which IP type is best for a given concern?

Today is the first of six Cottage Foodology newsletter articles on IP, basically a short introduction to the five types.

For the next five articles we are going to introduce you to these categories, one per newsletter, and give you at least a working knowledge of when to apply each in your food making endeavors.

These ALL do relate to making and selling food, depending on situation. Some relate very closely, and some only if you expand BEYOND cottage foods, or into complementary efforts such as cookbook publishing.

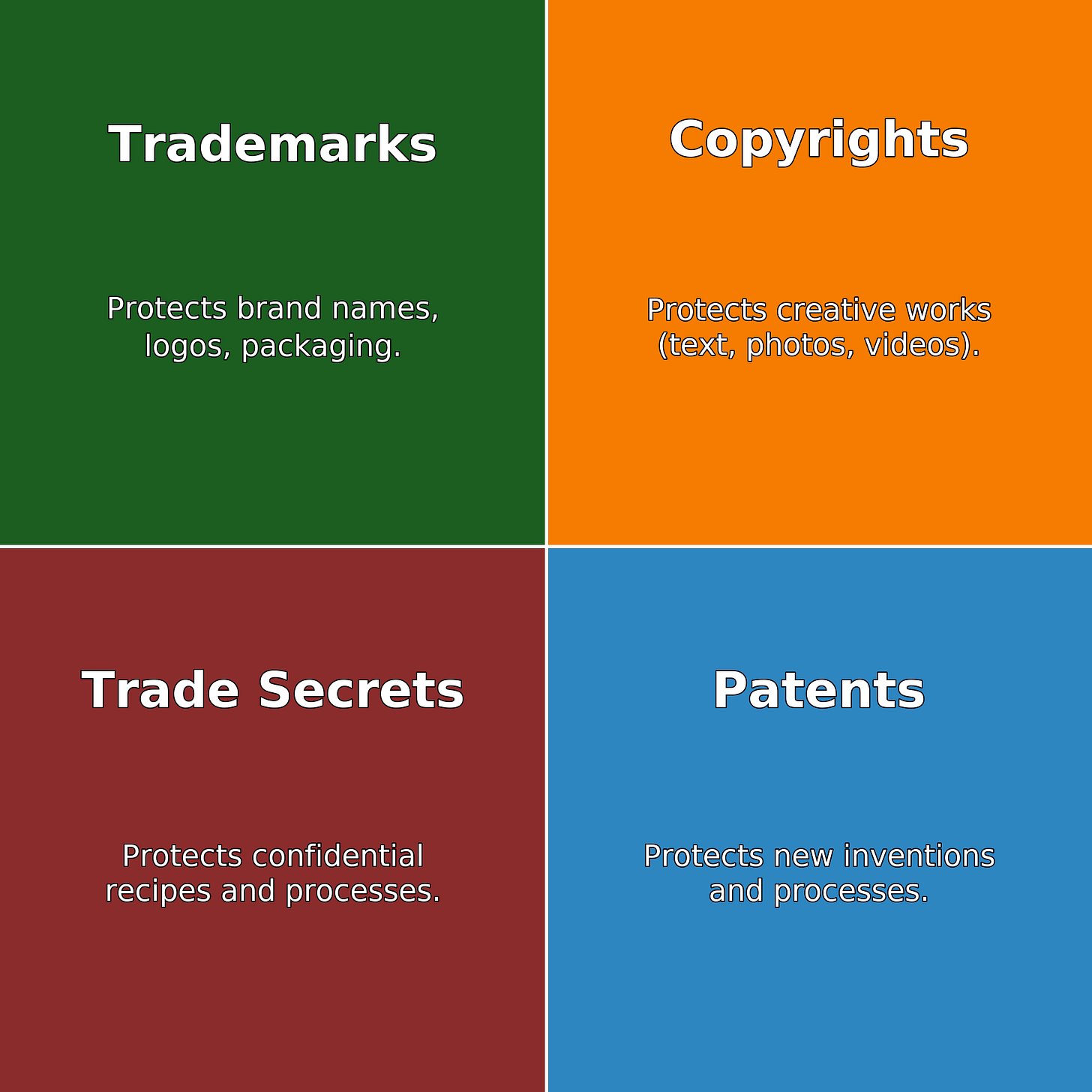

These five categories of IP protection include:

TRADEMARKS (#2)

COPYRIGHTS (#3)

TRADE SECRETS (#4)

PATENTS (#5)

NON-DISCLOSURE AGREEMENTS (NDAs) (#6)

We’ll talk about NDAs last, since they apply primarily for when you grow into advanced food manufacturing.

For example if you a co-packer to take you on, and you want to protect yourself from a recipe getting knocked off.

Or if you get so big and famous that you experience demand to license your recipe.

Here is an info-graphic to summarize the other four primary IP protections:

As a cottage foodie, you probably engage in TRADE SECRETS (Article #4 in this upcoming series). After all, you spent time developing your recipe and fine-tuning your business methodology. Once you give them away, they are in the public domain.

On the other hand, others give away their recipe, or charge a few dollars. To each their own vision, of what she or he wants to protect!

SPONSOR ANNOUNCEMENT: Many struggle with choosing a website platform suitable for a small food business. The New Kid on the Block in the dedicated foodie website market — and the only one providing either a free version (Pro upgrade is $20/month), or a lifetime $295 with Pro forever! — is Cottage CMS! Cottage baker and self-avowed “Techie” Andrew Meyer started Cottage CMS out of frustration with current options for his “Family Kneads” cottage food business he operates with his wife in Texas. CLICK HERE!Next up is the decision whether or not to spend the time and money to TRADEMARK your business name, brand, or even product names.

Many nuances to this discussion, including things you are unlikely to know, so this becomes a very valuable discussion for almost anyone in business.

Our next Cottage Foodology newsletter will be on trademarks (#2 in this series). Besides many facts about applying for a registered trademark, I offer up a tip for getting some free protection while avoiding the cost of Federal trademark registration. (Plus, how to avoid losing this protection…which most do!)

And at the end, I will offer one cheap hack primarily for cottage foodies, that provides substantial protection, again without the high cost of registration with the UNITED STATES PATENT and TRADEMARK OFFICE.

COPYRIGHTS are the most well-known IP protection type. And ironically, the most misunderstood.

Right now, there is a live survey in the Cottage Food Business Facebook community on the subject of copyrighting recipes. Several dozen comments, and answers are all over the map.

Check it out and provide your own votes and/or comments. (And see what I mean about “most misunderstood”. Even those with a background argue over what is and is not copyrightable…)

Anyway, we provide some guidance with article #3 in this series.

Last, but not least… well maybe least useful for a cottage food business… are PATENTS.

For article #5 we will cover the how patents fit in the grand scheme, and help you recognize if you stumble across something that might create a nice stream of income for you.

I will get this series out as quickly as my time allows. Let me know if there is something else you want to hear about. (Related to IP or anything other information or challenge a small food business might run across in their operations!)

Best wishes as we head into the fall and upcoming holiday season!

And Happy Labor Day, you hard working foodie in business!

Mal Dell

The MONETIZATION CHEF

Helping Foodies Cook Up Profits!

PS If you know someone who would like to write an article for Cottage Foodology, we are looking for a few good foodies!

Helpful Resources for Food Business Startups:

Food Handlers Training (Food Safe Pal):

Save $3 OFF the normal $15 fee by using the code: ‘MCHEF12’ at checkout. A fun, doodling technology approved in every state that requires a Food Handlers certificate. 100% online, and print off your certificate (and cards) after you pass the test with an 80%+. Recommended for cottage foodies operating in states that require an ANSI-certified Food Handlers course. And highly recommended in states that do not require any Food Safety training.

Recommended Insurance Options For Cottage and Other Small Food Businesses:

FLIP (Food Liability Insurance Program) - Specializing in insurance for FOOD BUSINESSES ONLY! The top business insurance choice for members of the Cottage Food Business community on Facebook. They know the food industry!

DEVELOP BUSINESS CREDIT RELATED TO YOUR EIN!!

THE best starter credit card for any small business is the CapitalOne Spark Card!

PS If you don’t yet enjoy a business credit score, you do need reasonable personal credit. If not, you might wait until you can say you’ve been in business for two years (the minimum threshold for many business cards.)

Perks: Get 1.5% cash back on EVERY purchase, or choose the 1.5% air mileage option, if you travel.

No annual fee. Plus, if you spend $4500 in the first three months, you get $500 rebate on your card. Stock up on packaging, labels, equipment and inventory for a whopping 11% discount out of the box at startup, or beginning of Farmers Market season.

CLICK HERE to see if you quality!

This card is easier to get than just about any other business credit card. As your business grows, you will get more card offers in the mail, allowing you to leverage and piggy back.

(PS Remember that only business interest is deductible on your Schedule C at income tax time!)

Miscellaneous

Today, we are going to jump into the subject of TRADEMARKS, what they are, how to search, and an obvious, but little known

Trademarks vs Copyrights